IFTA with Added Benefits

Save when you use ELDs and TruckEServices IFTA software.

Save when you use ELDs and TruckEServices IFTA software.

Saves Time: Don’t waste your time on data entry. Upload data from your ELD, GPS, Fuel Vendor directly into our IFTA road tax software instead of writing it down on Trip Sheets; E-file reports instead of mailing paper forms;

Saves Audit Flags: Our comprehensive IFTA diagnostic software identifies errors, gaps, and audit-flags prior to filing and gives you an IFTA audit report before you file reducing your audit risk.

IFTA filing couldn't be easier!

IFTA Road Taxes couldn’t be easier!

IFTA Road Taxes couldn’t be easier!

Input data once (manually or electronically) – reuse it to create tax returns, company reports, e-file, audit records;

Have one location to store all your permits and records that go anywhere;

Get rid of all the paper and stay organized;

One stop shop of specialists who know trucking, the kind of help you need – and when you need it.

Access your records from anywhere (internet connection required). Available access 24/7.

Road Taxes are Our Specialty

We specialize in road taxes, both 2290 and IFTA reporting.

We specialize in road taxes, both 2290 and IFTA reporting.

We’ve been in trucking over 80 years and developing technology tools for truckers since 1999. We know trucking.

Our mission is to provide the best Customer Service possible, including English and Spanish speaking support agents, with real people (not phone messaging systems). If you aren’t happy, we aren’t happy.

We are proud to be American; We offer old fashioned customer support, USA owned and operated.

Your satisfaction is guaranteed or we refund your money.

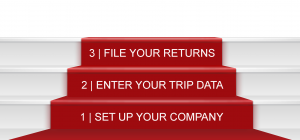

3-Step Setup

ELD’s are changing IFTA quarterly tax reports!

ELD’s are changing IFTA quarterly tax reports!

Our IFTA quarterly report software makes it easy as 1-2-3. Not only can we accept trip data from GPS and ELD technology, we can also use fuel vendor data. In addition, we can keep track of your permits, vehicle data, renewals, driver information and more!

Step 1 – Set up your company! First, set up your Contacts – second, set up your Permits – and third, set up your Vehicles. One place – lots of room! Keep names, contact information, Permit numbers, login user names and passwords, VIN numbers, expiration dates and so on! Once the initial set-up is completed, it’s EASY to maintain!

Step 2 – Enter your trip data. We offer you lots of different ways to enter data – manually key in each Trip Sheet – or upload data created by ELD’s, fuel vendors, routing software or dispatch software. We are already compatible with electronic logging devices (ELD’s) such as Comdata, Fleet One, Trimble, and others. If you already have a Fuel / ELD vendor sending you data, let us know and we can customize an upload just for you!

Step 3 – Prepare your tax returns. Once your Company is set up and your Trip Data entered, use our software to prepare your monthly tax reports, your IFTA quarterly tax reports, including your Kentucky, New Mexico, New York and Oregon tax reports.

After your truck and trip data is entered, you can also run extra reports and lists to help you manage your business. You can use TruckEServices Online Filing Cabinet to store all your tax returns, permits and important papers.

Filing History stores it all. What could be easier?

IFTA U.S. & Canada Filing Map

Go to your Support Center for more details.